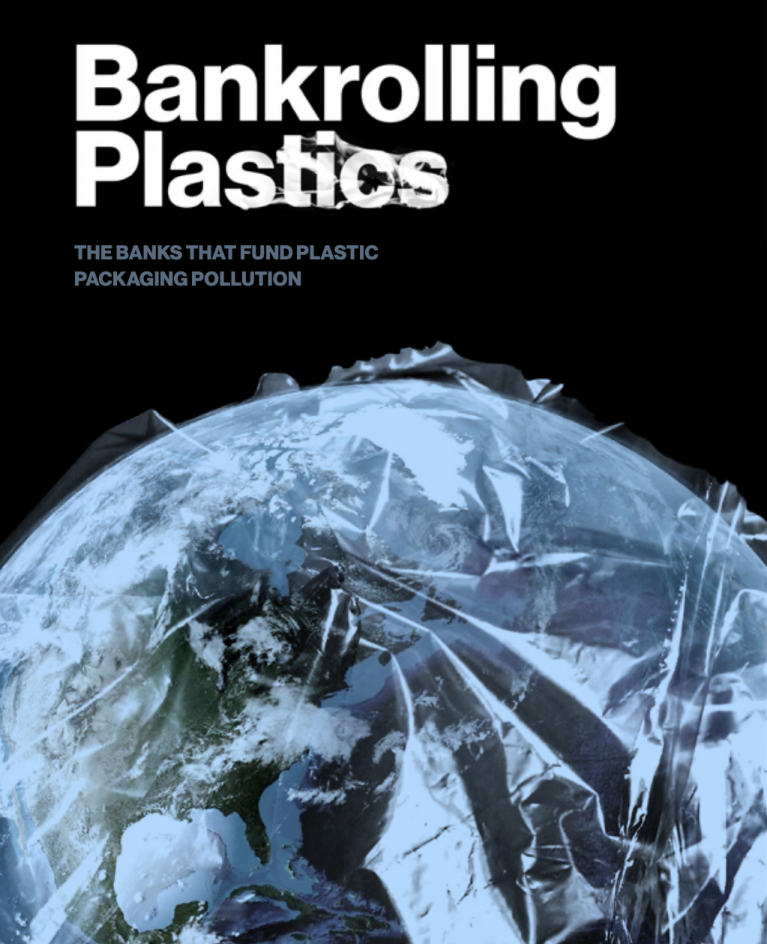

Bankrolling Plastics, a first-time ever investigation of the finance provided to key companies along the plastics supply chain has found that major banks are lending vast sums of capital without making any effort to address the plastic pollution crisis.

The assessment, carried out by portfolio.earth, found that between January 2015 and September 2019, 265 major banks provided loans and underwriting of more than USD 1.7 trillion, or USD 790 million per day, to 40 companies across the polymer, packaging, FMCG and retail industries, all key actors in the plastic packaging value chain. Twenty banks, mostly from the US and Europe, provided more than 80% of this funding (USD 1.4 trillion).

The ten largest financiers were Bank of America, Citigroup, JPMorgan Chase, Barclays, Goldman Sachs, HSBC, Deutsche Bank, Wells Fargo, BNP Paribas and Morgan Stanley. Together, they accounted for 62% of the finance identified.

The Bankrolling Plastics report was written by research network portfolio.earth, based on raw data for the loan and finance analysis commissioned from Profundo. The final analysis was audited by Vivid Economics. The report found that while many banks are aware of the plastic pollution crisis, none of the banks providing the bulk of the funding identified had developed any due diligence systems, contingent loan criteria, or financing exclusions for the plastics packaging industry. For example, no bank investigated has made their funding contingent on companies having policies to reduce the amount of plastic, or favour reusability and recycling over virgin plastics. This implies that banks are currently not taking any responsibility to understand, measure, or reduce the impacts of their loans within the plastics value chain.

Liz Gallagher, of portfolio.earth said: “Banks have fallen far behind the crowd of other actors that contribute to the plastic pollution crisis. They have developed a limited number of policies on fossil fuels and forest products but nothing on plastic”.

The findings fly in the face of the public outcry over the serious impacts of plastic pollution. Governments and scientists agree plastic pollution has no analogue in human history. Each minute, a truck full of plastics ends up in our oceans. Persistent harmful pollution from plastic packaging has now reached every corner of the planet from the deepest oceans to the top of Mount Everest with ingestion of plastic killing an estimated 1 million marine birds and 100,000 marine animals each year. The average person eats about 70,000 particles of microplastic a year.

Covid-19 has delayed efforts to curb the use of plastics, with the plastics and petrochemicals industry casting their services as ‘essential’, despite health experts agreeing that reusables can be used safely.

Bankrolling Plastics calls for banks to mitigate their role in enabling plastic pollution, along with a fundamental shift away from business models that depend on single-use packaging towards those that prioritise re-use and more localised supply chains and services.

It demands that:

- Banks make funding of corporate actors within the plastic packaging supply chain contingent on companies implementing best practice.

- Governments stop protecting banks and re-write the rules of finance to hold banks liable for the damage caused by their lending.

- Companies adopt international best practice to reduce the production and use of virgin plastic and increase the reusability of plastic packaging products.

“Bank lending to the plastics supply chain causes and contributes to pollution of the environment,” said Robin Smale, Director, of Vivid Economics.

“Banks need to mitigate their role in enabling plastic pollution in a number of ways, for example, by aligning their lending portfolios with public policy on plastic reduction, reusability and recycling and ceasing the financing of new plants that use virgin feedstock to produce single-use plastic packaging.”

Source

Bioplastics MAGAZINE, 2021-01-08.

Supplier

Bank of America

Barclays

Citibank

Deutsche Bank

Goldman Sachs

HSBC Bank plc

Morgan Stanley Institute for Sustainable Investing

Portfolio Earth (Bankrolling Plastics)

Vivid Economics

Share

Renewable Carbon News – Daily Newsletter

Subscribe to our daily email newsletter – the world's leading newsletter on renewable materials and chemicals