Global Bioenergies (the “Company“), the only company in the world to have developed a process to convert renewable resources into isobutene, is today announcing the launch of a capital increase through a public offer without preferential subscription rights for shareholders and without priority subscription period for existing shareholders, for an amount initially set at €17 million, which could be increased to a maximum of €19.5 million if the extension clause is fully exercised (the “Offer“).

The purpose of the Offer is to provide the Company with the means to:

- complete the development of the Isobutene process at laboratory scale, pilot scale and demo scale (for around 58% of the proceeds of the issuance);

- continue the R&D efforts to adapt the process to the use of second-generation and third-generation resources (for around 20% of the proceeds of the issuance);

- participate in financing the front-end engineering design (FEED) phase of the first plant, to be conducted by IBN-One, and support IBN-One in its fund-raising efforts to start the construction of the plant (for around 10% of the proceeds of the issuance);

- finance the regular running costs of the Company (for around 12% of the proceeds of the issuance).

The proceeds to be received in the context of the issuance of the New Shares are not intended to finance the construction of the plant IBN-One, for which the research of necessary funds is ongoing (for a total need of 140 M€).

As part of this Offer, the L’Oréal Group has committed, subject to certain conditions, to subscribe €7 million via its BOLD Business Opportunities for L’Oréal Development investment fund. Subject to ongoing discussions, L’Oréal and Global Bioenergies intend to sign within the next months an R&D collaboration which would continue and expand efforts already undertaken since 2016 to identify and validate isobutene derivatives for applications in cosmetics, as well as an isododecane supply agreement.

Marc Delcourt, Chief Executive Officer of Global Bioenergies, said: “This fundraising transaction will enable us to continue moving forward with IBN-One, the first plant project, which will have markets not only in the cosmetics but also in biofuels, and in particular aviation fuel.”

The capital increase will be made through the issuance of 3,655,914 new shares, i.e. 72.0% of the Company’s existing capital, at a unit share price of €4.65, representing a discount of 16.8% on Global Bioenergies’ closing share price on 18 June 2019 (€5.59) and a discount of 15.4% on the volume weighted average price over the last 3 trading sessions preceding the setting of the price. The issuance of the New Shares will be carried out without any priority subscription period for existing shareholders.

This Offer is managed by Gilbert Dupont as the sole Lead Manager and Bookrunner.

Subscription intentions and commitments of the main shareholders and new investors

Two CM-CIC funds (CM-CIC Innovation and CM-CIC Investissement SCR), shareholders holding together 422,304 shares in the Company (i.e. 8.31% of the capital), have made a firm commitment to subscribe to the Offer in cash in proportion to their current equity stake, i.e. 8.31% of the gross Offer amount.

The BOLD Business Opportunities for L’Oréal Development fund, a subsidiary of the L’Oréal group, has made a firm commitment to subscribe €7 million in cash (i.e. 41.2% of the Offer’s gross amount), notably subject to certain conditions of price, minimum amount of capital increase and percentage of shareholding. As part of this subscription commitment, it is expected that a representative of BOLD Business Opportunities for L’Oréal Development will be thus appointed as an observer on the Company’s Board of Directors[2].

In addition, several institutional investment funds have also made irrevocable commitments to subscribe to the Offer for an amount of €5.2 million, representing 30.8% of the gross amount of the Offer, none of these subscription commitments representing more than 5% of the share capital after issuance of the new shares.

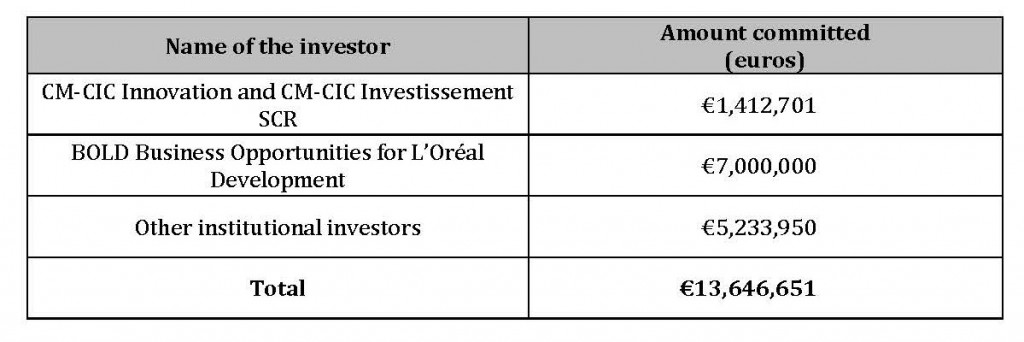

The table hereafter describes in detail the total subscription commitments received by the Company:

In total, the subscription commitments received by the Company from some historical shareholders as well as investors described here above represent around 80,3% of the gross amount of the Offer (without exercise of the extension clause).

The Company is not aware of the intentions of other shareholders or members of its Board of Directors.

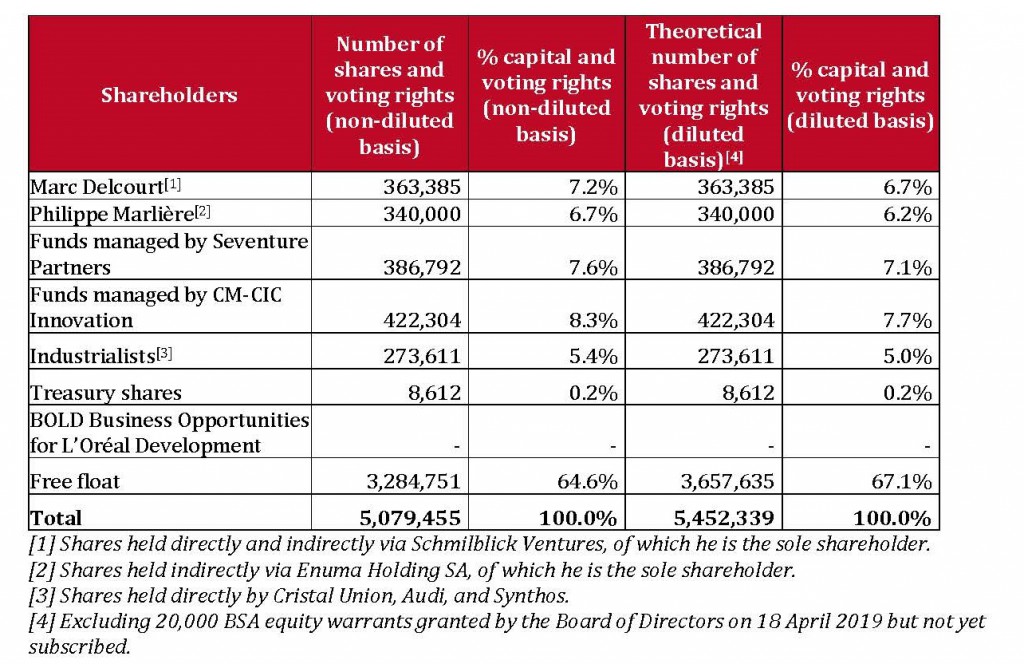

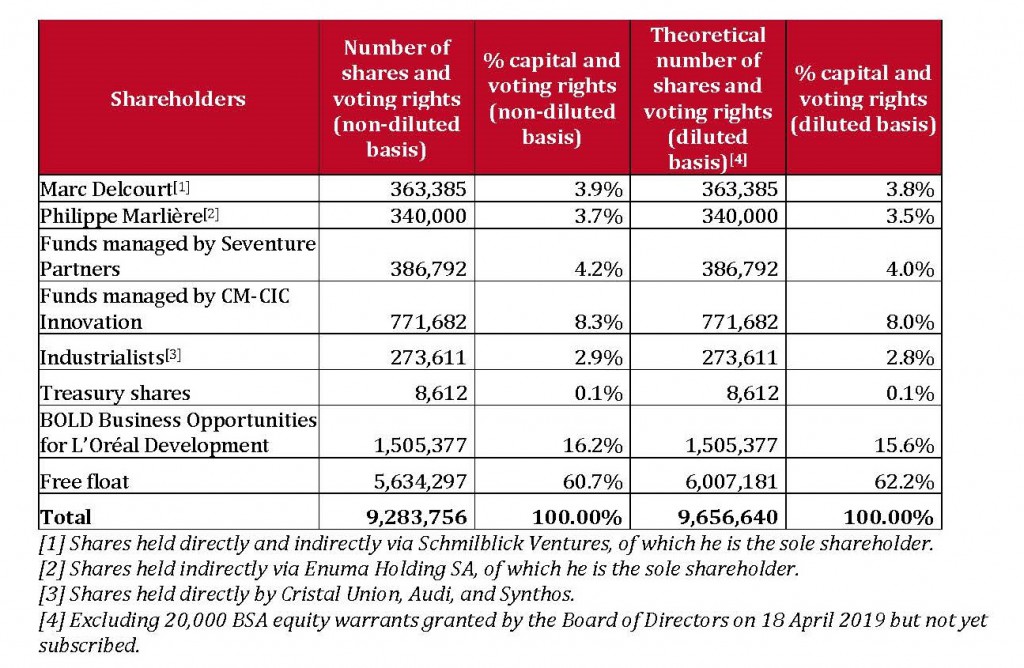

The breakdown of the Company’s share capital before the Offer is as follows:

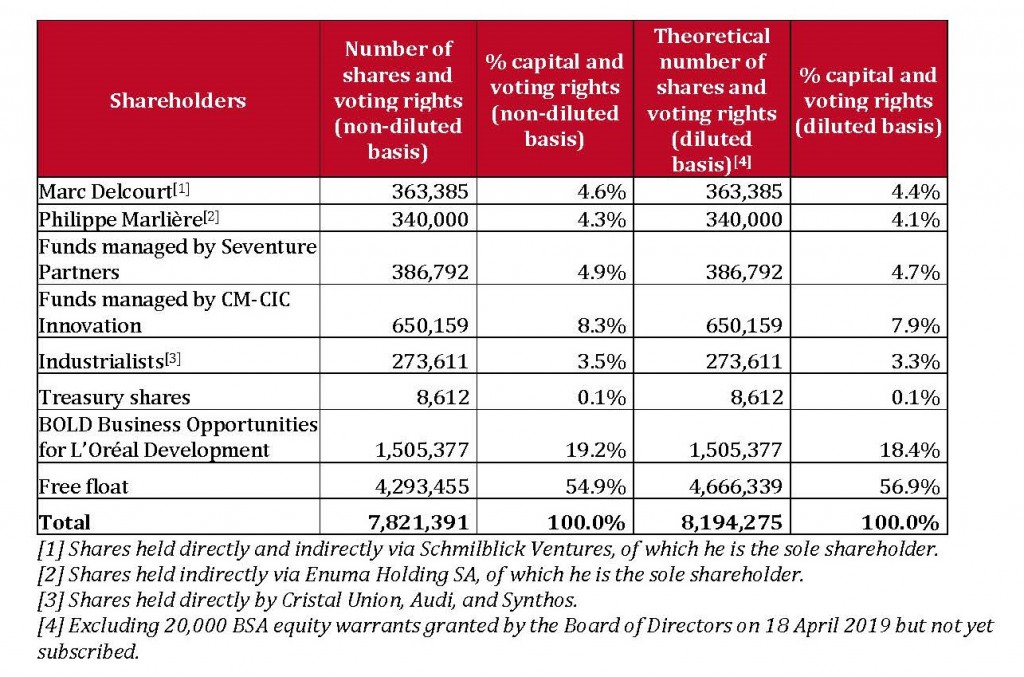

The breakdown of the Company’s share capital after the Offer if 75% of the initial new shares are allocated is as follows:

After the Offer with 100% of the initial new shares allocated:

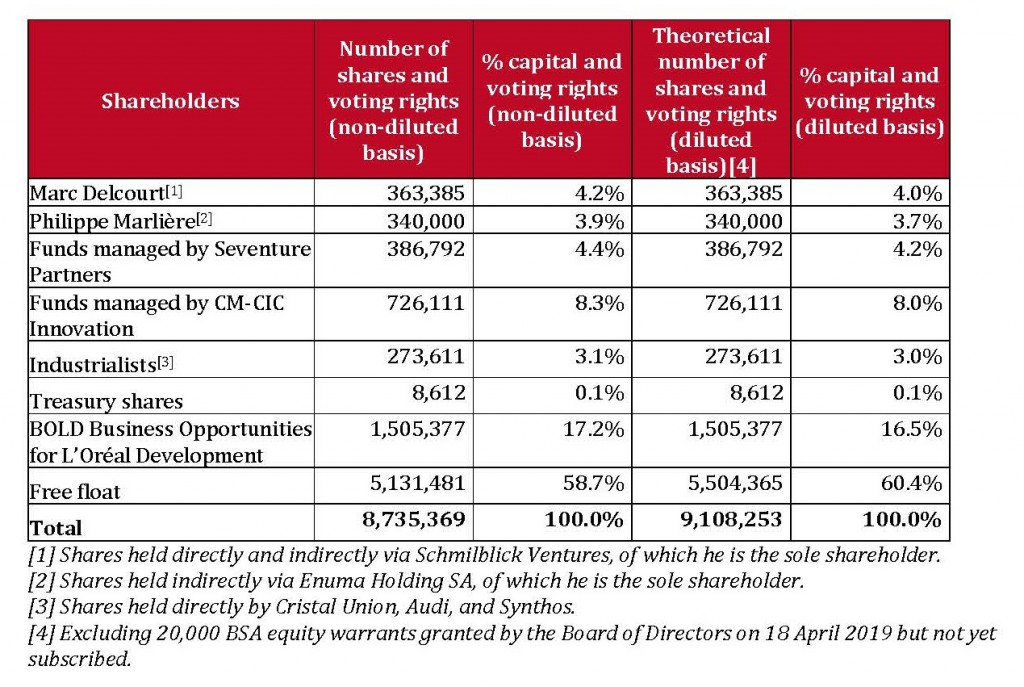

After the allocation of 100% of the initial new shares and full exercise of the extension clause:

Lock-up undertakings

The Company has committed towards the Lead Manager and Bookrunner not to issue, offer or dispose of any shares or securities giving direct or indirect access to shares in the Company for a 90-day period from the settlement date of the new shares, subject to standard exceptions and the ability to implement any issue transaction reserved for an industrial investor at a unit share price higher or equal to the Offer subscription price.

BOLD Business Opportunities for L’Oréal Development has committed towards the Company and the Lead Manager and Bookrunner to a lock up on 100% of the new shares subscribed as part of the Offer for a 90-day period from the new share settlement date, subject to the standard conditions.

Guarantee

The Offer is not subject to a guarantee agreement.

In the event of insufficient demand, the planned capital increase may be limited to the subscriptions received insofar as these represent 80.3% of the initially planned issuance, which would not affect the Company’s objectives.

Main characteristics of the capital increase

Share capital prior to the transaction

As of the date of the Securities Note, Global Bioenergies’ capital is €253,972.75 and consists in 5,079,455 ordinary shares, fully subscribed and paid-up, with a par value of €0.05 each.

Share codes

ISIN code: FR 0011052257

Mnemonic code: ALGBE

Listed at: Euronext Growth Paris

Number of new shares to be issued

3,655,914 shares, that may be increased by 548,387 shares in the event that the extension clause is fully exercised, i.e. a maximum of 4,204,301 shares in total.

New shares subscription price

4.65 euros per share (of which €0.05 in par value and €4.60 share premium) to be fully paid-up in cash at subscription, representing a discount of 16.8% to the Global Bioenergies closing share price on the trading day preceding the visa from the AMF for the Prospectus (i.e. €5.59 on 18 June 2019) and a discount of 15.4% on the volume weighted average price over the last 3 trading sessions preceding the setting of the price.

Gross issue amount

Around €17 million, which may be increased to around €19.5 million if the extension clause is fully exercised.

Structure of the Offer and indicative timetable

The capital increase is carried out without preferential subscription rights and without priority subscription period for existing shareholders.

The issuance of the New Shares will be carried out as part of the Offer comprising:

- a public offering in France only, open from 20 June 2019 to 25 June 2019, 5 pm (Paris time), in the form of a fixed price offer, mainly aimed at individuals (the “Fixed Price Offer“); and

- a global placement mainly intended for institutional investors (the “Global Placement“), open from 20 June 2019 to 25 June 2019, 6 pm (Paris time) comprising:

- a private placement in France aimed mainly at qualified investors and those providing a portfolio management investment service on behalf of third parties; and

- a private international placement aimed at institutional investors in certain countries, other than the United States of America notably.

Subscription orders under the Global Placement and the Fixed Price Offer may be reduced according to the nature and amount of demand.

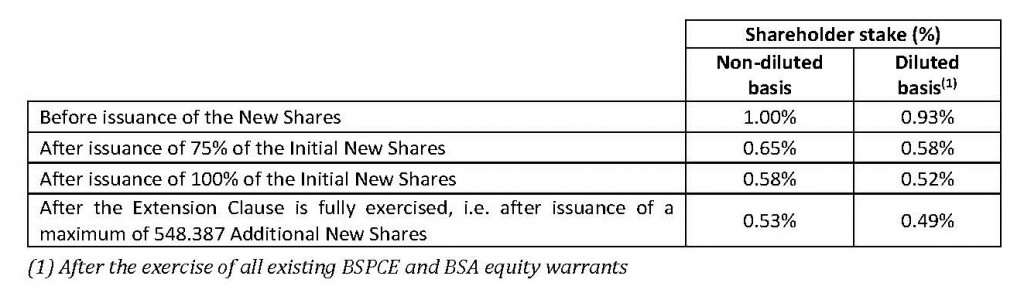

Amount and percentage of immediate dilution resulting from the Offer

The impact of the issue on the stake of a shareholder holding 1% of the Company’s share capital prior to the Offer and not subscribing to the Offer (calculation based on the number of shares that make up the capital as at the date of the Prospectus, i.e. 5,079,455 shares) would be as follows, under the following assumptions:

- the issue of 3,655,914 Initial New Shares, increased to a maximum of 4,204,301 New Shares in the event of full exercise of the Extension Clause,

- the charging of Offer-related costs against the share premium, with no tax impact.

Availability of the Prospectus

Global Bioenergies has filed its Registration Document dated 4 March 2019 with the French Financial Markets Authority (AMF) under number D.19-0091 (the “2018 Registration Document“).

Copies of the Registration Document are available free of charge at the registered office of Global Bioenergies – 5, rue Henri Desbruères, 91000 Evry – France. This document may also be examined online on the sites of the AMF (www.amf-france.org) and of the Company (www.global-bioenergies.com).

The prospectus (the “Prospectus“) with visa n°19-275 dated 19 June 2019 comprises (i) the 2018 Registration Document, (ii) a securities note (the “Securities Note“); and (iii) the summary of the Prospectus (included in the Securities Note).

Copies of the Prospectus are available free of charge at the registered office of Global Bioenergies – 5, rue Henri Desbruères, 91000 Evry – France. This document may also be examined online on the sites of the AMF (www.amf-france.org) and of the Company (www.global-bioenergies.com).

Before deciding whether to invest, investors should consider the risk factors referred to in chapter 4 of the 2018 Registration Document (provided that the risk factors in this chapter have been updated as displayed in section 10.5.1 of the Securities Note), as well as chapter 2 of the Securities Note. The occurrence of one or more of these risks could have a negative impact on the business, financial situation, results, development or outlook of Global Bioenergies.

Source

Global Bioenergies, press release, 2019-06-20.

Supplier

French Mayors Association (AMF)

Global Bioenergies

L'Oreal New Zealand group

Share

Renewable Carbon News – Daily Newsletter

Subscribe to our daily email newsletter – the world's leading newsletter on renewable materials and chemicals