Berlin, 23 July 2019. France is tightening up regulations on the use of palm oil as a feedstock in biofuels production. However, this only applies to palm oil eligibility within France. As a result, biofuels produced in France could push their way onto the EU market, toughening supply and price competition.

The French regulation No. 2019-570 published last month ends the eligibility of biofuels such as palm oil methyl ester (biodiesel) and hydrogenated vegetable oil from palm oil (HVO) for public funding. The regulation will come into force on 1 January 2020 together with the new tax system. It also provides that as of 31 December 2019, economic operators will no longer be allowed to include palm oil-based biofuels in their mass balances.

This provision especially affects the mineral oil group Total. The group only took the refinery at La Mède into operation to produce HVO in July 2019. The plant has an annual capacity of 500,000 tonnes. According to the Total group, the maximum amount of palm oil processed will be 300,000 tonnes and the minimum amount of rapeseed oil from French production will be 50,000 tonnes. The remaining supply need of 150,000 tonnes is to be covered with used oils and animal fats (UCO). In other words, the French government is implementing the authorisation regulation introduced by the EU iLUC Regulation (2015/1513/EU) and continued by the revised Renewable Energy Directive (RED II). The regulation allows member states to prepone the phase-out of palm oil-based fuels instead of starting to discontinue their use, based on the quantity sold in 2019, from 2024 onwards and end it altogether by 2030. In this sense, France will fulfil its obligation ten years earlier.

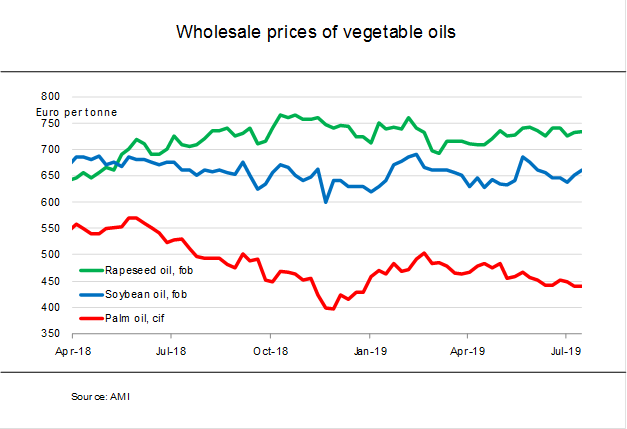

The Union zur Förderung von Oel- und Proteinpflanzen (UFOP) urges the German government to follow the French example and ban palm oil as soon as possible. UFOP basically welcomes the constraint that excludes palm oil from producers’ mass balances, because biofuels feedstocks must be delivered physically rather than being documented on paper. The feedstocks also fall under the national caps on biofuels from cultivated biomass, which in Germany is 6.5 per cent. This is why UFOP fears that there will be shifts in the market if the Total plant eventually produces palm oil-based HVO that will be exported for account purposes in other member states. The international vegetable oil markets are characterised by considerable supply and, consequently, price pressure as it is, the association has emphasised to support its call. The importance of the European biodiesel market is shown in 4 million hectares of rapeseed cultivation and the amount of GM-free high-protein animal feed generated as a by-product of rapeseed oil production, UFOP has underlined. According to UFOP, the sustainability of soybean production should be doubted, especially since the Brazilian government changed.

According to information published by Agrarmarkt Informations-Gesellschaft (AMI), the Council of Palm Oil Producing Countries (CPOPC), of which Indonesia and Malaysia are members, has announced that it will bring a complaint before the World Trade Organisation (WTO) to challenge the constraint.

Source

UFOP, press release, 2019-07-23.

Supplier

Agrarmarkt Informations-GmbH (AMI)

Council of Palm Oil Producing Countries (CPOPC)

Total

Union zur Förderung von Oel- und Proteinpflanzen e.V. (UFOP)

World Trade Organization (WTO)

Share

Renewable Carbon News – Daily Newsletter

Subscribe to our daily email newsletter – the world's leading newsletter on renewable materials and chemicals