The comprehensive 500 page-market study and trend reports on “Bio-based Building Blocks and Polymers in the World – Capacities, Production and Applications: Status Quo and Trends Towards 2020” was published today. Authors are experts from the German nova-Institute in cooperation with ten renowned international experts.

Bio-based drop-in PET and the new polymers PLA and PHA show the fastest rates of market growth. The lion’s share of capital investment is expected to take place in Asia.

Two years after the first market study was released, Germany’s nova-Institute is publishing a complete update of the most comprehensive market study of bio-based polymers ever made. This update will expand the market study’s range, including bio-based building blocks as precursor of bio-based polymers. The nova-Institute carried out this study in collaboration with renowned international experts from the field of bio-based building blocks and polymers. The study investigates every kind of bio-based polymer and, for the first time, several major building blocks produced around the world, while also examining in detail 112 companies.

In 2014, for the first time, the association “European Bioplastics” used nova-Institute’s market study as its main data source of their recently published market data. For the European Bioplastics’s selection of bio-based polymers, which differs from nova-Institute’s selection, bio-based polymers production capacities are projected to grow by more than 400% by 2018.[1]

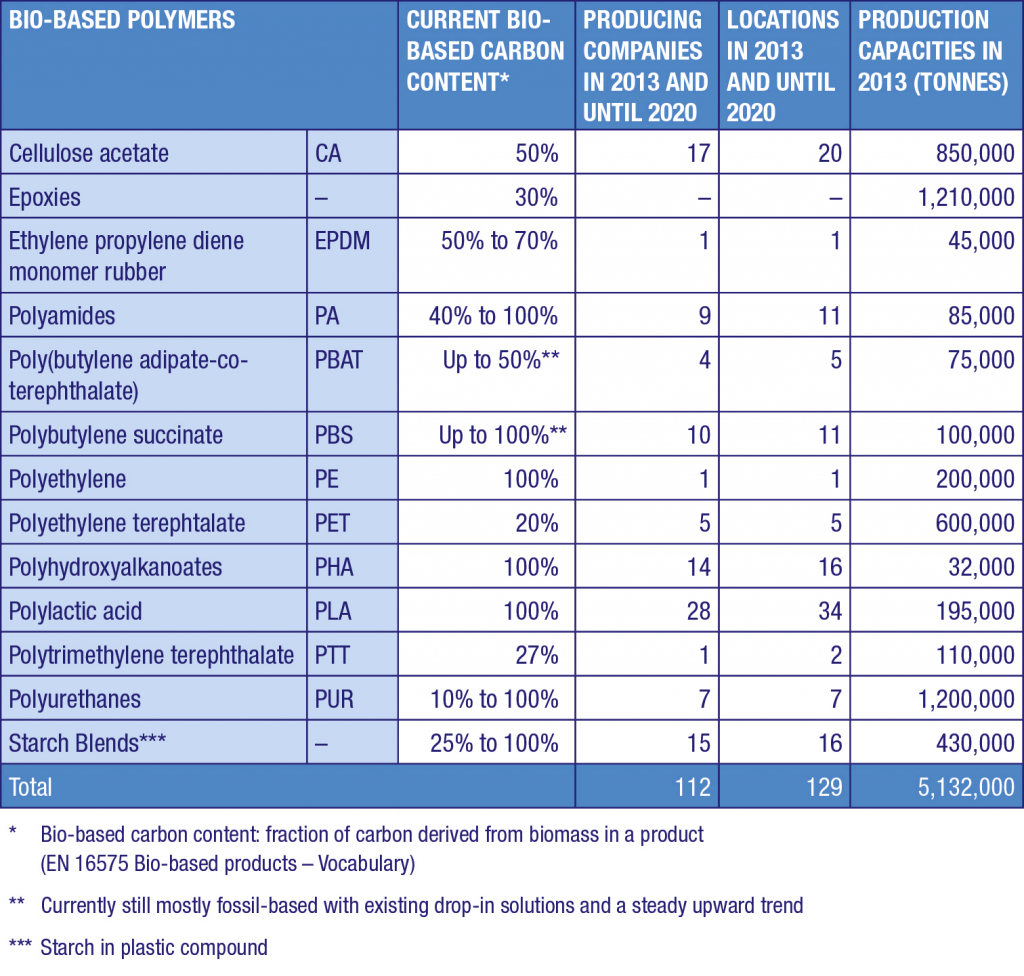

The production capacity for bio-based polymers boasts very impressive development and annual growth rates, with a compound annual growth rate (CAGR) of almost 20% in comparison to petrochemical polymers, which have a CAGR between 3-4%. The 5.1 million tonnes bio-based polymer production capacity represent a 2% share of overall structural polymer production at 256 million tonnes in 2013 and a bio-based polymer turnover of about €10 billion (5 Mio. t (production capacity) x 2.50 €/kg (estimated average bio-based polymer price) x 0,8 (capacity utilization rate)).

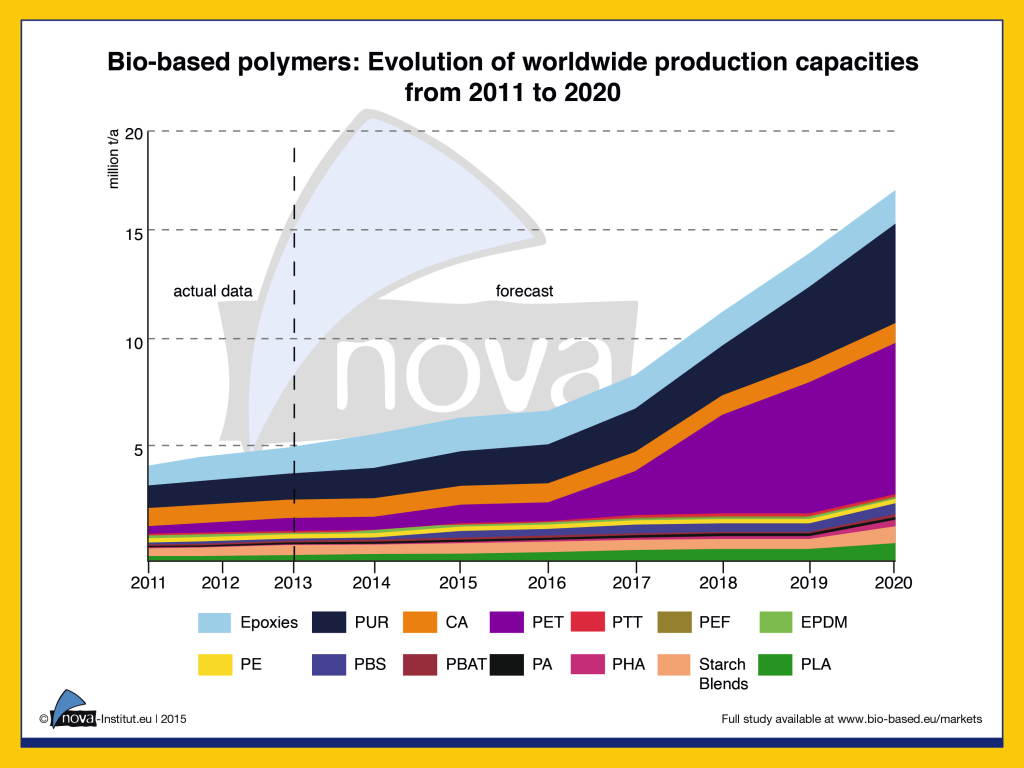

This bio-based share of overall polymer production has been growing over the years: it was 1.5% in 2011 (3.5 million tonnes bio-based for a global production of 235 million tonnes). Current producers of bio-based polymers estimate that production capacity will reach 17 million tonnes by 2020. With an expected total polymer production of about 400 million tonnes in 2020, the bio-based share should increase from 2% in 2013 to more than 4% in 2020, meaning that bio-based production capacity will grow faster than overall production.

The most dynamic development is foreseen for drop-in bio-based polymers, but this is closely followed by new bio-based polymers. Drop-in bio-based polymers are chemically identical to their petrochemical counterparts but at least partially derived from biomass. This group is spearheaded by partly bio-based polyethylene terephthalate (PET) whose production capacity was around 600,000 tonnes in 2013 and is projected to reach about 7 million tonnes by 2020, using bio-ethanol from sugar cane. Bio-based PET production is expanding at high rates worldwide, largely due to the Plant PET Technology Collaborative (PTC) initiative launched by The Coca-Cola Company. The second most dynamic development is foreseen for polyhydroxyalkanoates (PHA), which, contrary to bio-based PET, are new polymers, but still have similar growth rates to those of bio-based PET. Polylactic acid (PLA) and bio-based polyurethanes (PUR) are showing impressive growth as well: their production capacities are expected to almost quadruple between 2013 and 2020.

Most investment in new bio-based polymer capacities will take place in Asia because of better access to feedstock and favorable political framework. Europe’s share is projected to decrease from 17% to 8%, and North America’s share is set to fall from 18% to 4%, whereas Asia’s is predicted to increase from 51% to 76%. South America is likely to remain constant with a share at around 12%. In other words, world market shares are expected to shift dramatically. Asia is predicted to experience most of the developments in the field of bio-based building block and polymer production, while Europe and North America are slated to lose more than a half and just over three quarters of their shares, respectively.

The forecast of a total production capacity of 17 million tonnes of bio-based polymers suggests that the market is definitely well established and growing. It is also shown that the development of bio-based polymers is still very dynamic.

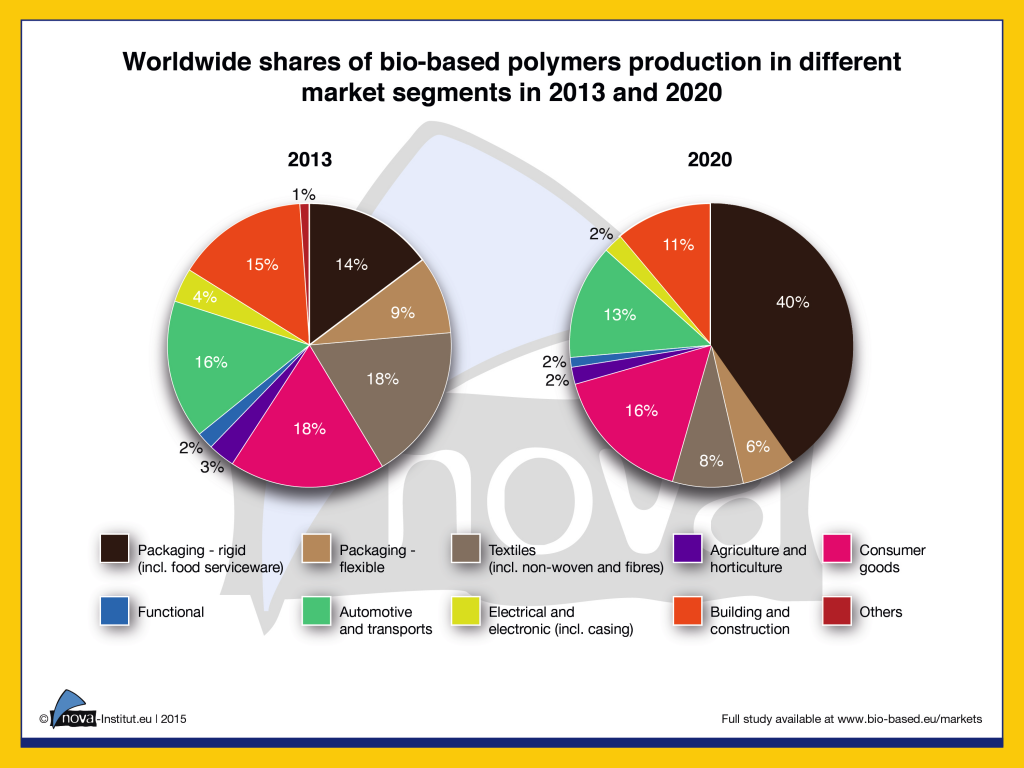

The following figure shows the worldwide shares of bio-based polymers production in different market segments in 2013 and 2020.

This 500 page-report presents the findings of nova-Institute’s market study, which is made up of three parts: “market data”, “trend reports” and “company profiles” and contains over 200 tables and figures.

The “market data” section presents market data about total production capacities and the main application fields for selected bio-based polymers worldwide (status quo in 2013, trends and investments towards 2020).. This part not only covers bio-based polymers, but also investigates the current bio-based building block platforms.

The “trend reports” section contains a total of eleven independent articles by leading experts in the field of bio-based polymers These trend reports cover in detail every recent issue in the worldwide bio-based polymer market.

The final “company profiles” section includes 96 company profiles with specific data including locations, bio-based polymers, feedstocks and production capacities (actual data for 2011 and 2013 and forecasts for 2020). The profiles also encompass basic information on the companies (joint ventures, partnerships, technology and bio-based products). A company index by polymers, with list of acronyms, follows.

The full report can be ordered for €3,000 plus VAT and the short version of the report can be downloaded for free at www.bio-based.eu/markets.

Contact:

Dipl.-Ing. Florence Aeschelmann

Phone: +49 (0) 22 33-48 14-48

florence.aeschelmann@nova-institut.de

Download the figures included in the press release. Use of the material is free of charge for press purposes. Please include the source. www.bio-based.eu/market_study/media/15-05-12-Graphics-biopolymers-nova.zip

Download this press release as PDF file: 15-05-12_PR_Market_Study_and_Trend_Reports_on_Bio-based_Building_Blocks_and_Polymers_in_the_World_nova

[1] Market data graphics are available for download in English and German: http://en.european-bioplastics.org/press/press-pictures/labelling-logos-charts/

Source

nova-Institut GmbH, press release, 2015-05-12.

Supplier

Coca-Cola Co.

European Bioplastics e.V.

nova-Institut GmbH

Share

Renewable Carbon News – Daily Newsletter

Subscribe to our daily email newsletter – the world's leading newsletter on renewable materials and chemicals