Corbion reported Q4 2014 sales of € 200.6 million, an 8.7% increase compared to Q4 2013, driven by organic sales growth (2.9%) and currencies (5.8%). The Biobased Ingredients business unit grew sales organically by 2.0%; this comprised flat growth at Food, and 8.2% growth in Biochemicals. EBITDA before one-off costs in Q4 2014 increased significantly by 35.9% to € 30.3 million. Organic EBITDA growth in Q4 2014 amounted to 26.0%.

“I am happy to report that Corbion ended 2014 on a high note. Particularly EBITDA grew significantly in the 4th quarter. In the Strategy Update we presented our vision of disciplined value creation which will create a more competitive and profitable Corbion. Productivity improvement program Streamline, is firmly underway with our new organization in place and detailed implementation plans having been developed. Successful execution of this program will be an important focus for us in 2015.”, comments Tjerk de Ruiter, CEO.

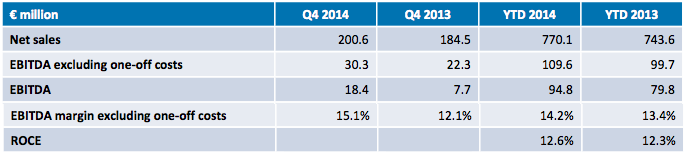

Key financial highlights Q4 2014:

- Net sales in Q4 increased by 8.7% to € 200.6 million, 2.9% organic growth

- EBITDA excluding one-off costs in Q4 was € 30.3 million, an organic increase of 26.0% EBITDA margin excluding one-off costs was 15.1% in Q4 (Q4 2013: 12.1%)

- One-off costs in Q4 were € 37.8 million (FY 2014: € 58.5 million), mainly related to the Strategy Update

Key financial highlights FY 2014:

- Net sales in FY 2014 increased by 3.6% to € 770.1 million, 3.2% organic growth

- EBITDA excluding one-off costs in FY 2014 was € 109.6 million, an organic increase of 10.8%

- Net cash at the end of 2014 was € 5.8 million (2013: net cash of € 29.4 million)

- Proposed regular dividend of € 0.21 per share payable in cash or shares (2013: € 0.15) and € 100 million return to shareholders in 2015

Management review Q4 2014

Note: Data for operational segments below are presented using the new segments announced at the Strategy Update on 30 October 2014. Comparative information for 2013 has been restated according to the new segments.

Net sales

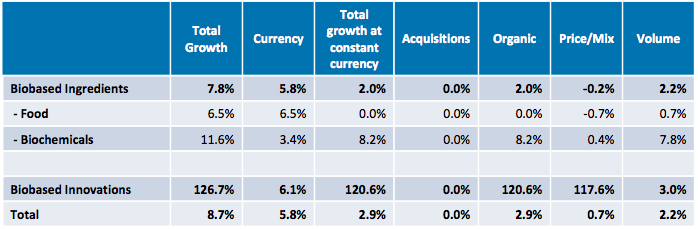

Net sales in Q4 increased by 8.7% to € 200.6 million (Q4 2013: € 184.5 million) due to both organic growth (2.9%) and currency movements (5.8%). The currency impact was mainly caused by the stronger US dollar against the Euro. Organic sales growth in Biobased Ingredients was 2.0%, comprising volume growth of 2.2% and price/mix effects of -0.2%. Volume growth was broad based in all regions and markets, except for Bakery. The negative price/mix trend was mainly driven by lower prices in Meat North America and lower Emulsifier pricing (following the reduction in raw material prices). Sales growth in Biochemicals was broad based, notably in Medical Biomaterials, Agrochemicals, Pharma, and Electronics. The organic growth in Biobased Innovations was driven by lactide sales. The price/mix impact in Biobased Innovations related to a shift in the portfolio to higher value-added products.

Q4 2014 compared to Q4 2013

EBITDA

EBITDA (excluding one-off costs) increased by 35.9% to € 30.3 million. This increase was driven by organic growth of 26.0% and included a positive currency impact of € 2.2 million. The organic growth was driven mainly by positive volume and mix effects; costs moved in line with the inflation rate. EBITDA growth included a positive absorption impact of € 2.1 million (fixed cost recovery related to stock increase) and a contribution related to the usage of our Spanish facilities by Succinity. The increase in stock is driven by additional positions in raw materials and increased safety stock levels of finished products.

Management review FY 2014

Net sales

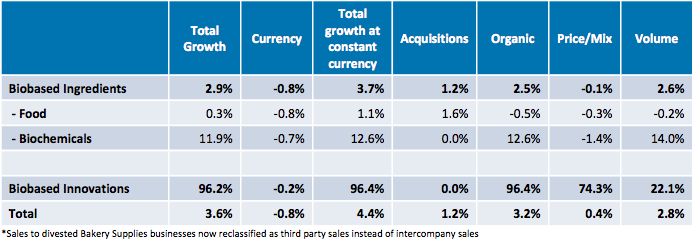

Net sales in 2014 increased by 3.6% to € 770.1 million (2013: € 743.6 million) mainly driven by organic growth (3.2%). Exchange rate movements impacted the sales figures negatively by € 5.9 million mainly driven by the weakening of the Brazilian real and Japanese yen. The acquisition impact related to the divestment of the Bakery Supplies businesses which we treated as intercompany sales in H1 2013.

Organic growth in the Biobased Ingredients business unit of 2.5% was mainly driven by the business segment Biochemicals. In the business segment Food, volume growth was slightly negative due to industry consolidation in the bakery market segment and the ongoing impact of the earlier legislative change in the US on the meat market segment. Price/mix in Food was slightly negative as a result of lower raw material prices. In the Biochemicals business segment, volumes increased by 14.0% driven by product introductions and a widening geographical spread. The growth in Biobased Innovations, which was mainly driven by Bioplastics, contributed 0.7% points to the overall organic growth.

FY 2014 compared to FY 2013

… to read the full report, klick here.

Source

Corbion, press release, 2014-02-26.

Supplier

Share

Renewable Carbon News – Daily Newsletter

Subscribe to our daily email newsletter – the world's leading newsletter on renewable materials and chemicals