Shanghai, China-based bio-butanol producer Cathay Industrial Biotech filed an S-1 form last week with the US Securities and Exchange Commission (SEC) hoping to raise up to $200m in an initial public offering (IPO) on the NASDAQ stock exchange.

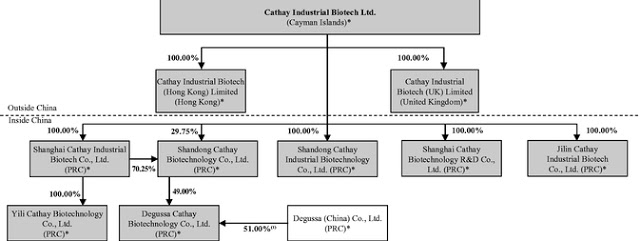

I can’t explain the company’s corporate structure but maybe this diagram will help:

Cathay Industrial Bio currently produces corn-based n-butanol for chemical applications at its 100,000 tonnes/year biorefinery in Jilin Province, China. The facility, which uses the acetone-butanol-ethanol (ABE) fermentation route, started production in 2009 of about 65-70% butanol, 20-25% acetone and 5-10% ethanol.

The company claimed to be the world’s largest bio-butanol producer based on active production capacity this year (backed by report from consulting firm CMAI). It’s n-butanol is currently used as an industrial solvent and as a chemical intermediates for the production of paints, resins, coatings, plasticizers, herbicides, pharmaceuticals and food grade extractants.

The blog also previously mentioned the company’s bio-dibasic and dicarboxylic acid businesses via fermentation of paraffins. In its S-1 form, the company said they are producing long chain diacids (LCDAs) at its13,500 tonnes/year facility in Shandong Province, China. The facility is expected to increase production to 15,000 tonnes/year by the end of 2011, and 20,000 tonnes/year by the end of 2012.

Their LCDAs, which are used as chemical intermediates primarily for the production of nylon, plastics, adhesives, fragrances, lubricant and powder coatings are reportedly sold to a broad base of customers that includes Du Pont, Evonik Industries, International Flavors & Fragrances (IFF), Arkema, Novo Nordisk A/S, and major China-based companies.

The company also intends to produce LCDAs using vegetable oil and bio-based oil although the S-1 reported risks in economics and regulatory factors for sourcing vegetable oil, while “there are currently only a limited number of suppliers who have the capability to produce bio-based oils and they may not be able to meet our quality, quantity and cost requirements.”

As for competitors in the LCDA sector, the company cited US-based Invista; Germany-based Evonik and Japan-based Ube Industries (all petro-based LCDAs). Cathay Industrial Bio also reportedly competes with China-based LCDA producers who also use bioprocess similar to theirs.

Check out the S-1 filing for more on the LCDA market. Butadiene is said to be the feedstock for petroleum-based LCDA, and the blog’s readers already know how tight the butadiene market is right now.

Interestingly enough, sebacic acid (or decanedioic acid) was also noted as one of Cathay Industrial Bio’s products. Sebacic acid is used in several low volume applications such as polyamides, plasticizers, adhesives, lubricants and cosmetics and more than 90% are produced in China. I’ve covered sebacic acid before as the raw material is based on castor oil.

Butanol Market Overview

Returning to bio-butanol, the company expects to begin pilot stage testing of a biomass-based n-butanol production (using corn cobs and corn stover) by the end of 2011, adjacent to its current biobutanol production. Cathay Industrial Bio plans to expand its biobutanol (and co-products) manufacturing facility to 200,000 tonnes/year – 130,000 tonnes/year specifically for biobutanol – in the future.

N-butanol, by the way, is a little different from Gevo’s/Butamax’s isobutanol although both can be used for fuel (according to Cathay Industrial Bio). Other biobased n-butanol producers/developers include Cobalt Technologies, TetraVitae Bioscience, METabolic EXplorer, Green Biologics and Jilin Jian New Energy Group, according to the S-1 filing.

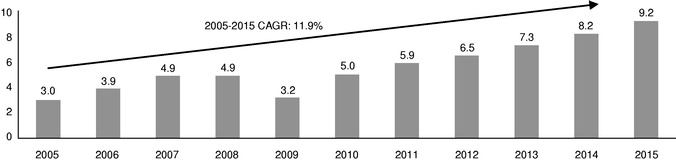

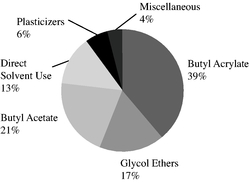

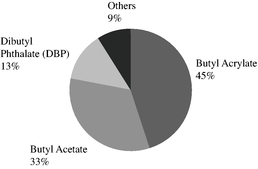

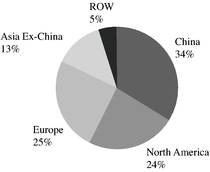

Here are some nice graphics from the S-1 filing about the butanol market in general.

Global Butanol Market Size (US$ in billions)

Global Butanol demand by Applications in 2010

Global Butanol demand by Region in 2010

The S-1 Filing also noted China’s butanol market where it is said to be the largest worldwide with a capacity of 1.047m tonnes in 2010 compared to 525,000 tonnes in 2005. According to consulting firm Nexant, demand for butanol in China is expected to grow to 1.35m tonnes in 2015. Effective butanol production capacity in China last year was 550,000 tonnes.

I’m trying to find out why the production is so low but one thought that pops in my mind is because of the energy/electricity issue last year in China which led to several manufacturing facilities across China cutting down operating rates.

By the way, Cathay Industrial Bio also noted this risks in their S-1:

“We use a significant amount of utilities such as electricity, steam and water during our production processes. The cogeneration plant at our biobutanol production facility is operated by us, and we purchase coal to operate this plant, whereas the cogeneration plant at our LCDA production facility is owned and operated by a local utility company. We cannot assure you that we will not experience supply disruptions for electricity, steam or water. We may also require increased supplies of electricity, steam and water due to increasing production activities and may not be able to obtain such increased supplies. Coal prices have also increased significantly in recent years. Continued increases in utility prices or shortages of utility supplies will increase our costs of production and may materially and adversely affect our results of operations.”

So back to the butanol market, China is said to be a current net importer of butanol and is expected to continue to remain so through 2015. More than 70% of the current petroleum-based n-butanol’s cash cost is related to propylene pricing, hence Chinese n-butanol and propylene prices are highly correlated, according to the company.

I’ve been checking out ICIS Pricing’s reports on Chinese n-butanol and current price is in the range of $2,020/tonne ex-tank, south China compared to last year’s $1,697/tonne (of course, you have to factor in currency exchange values). Domestic prices for n-butanol in China are actually going down a bit because of weak demand from downstream butyl acrylate (BA) and butyl acetate (BAC) markets.

China’s Butanol Demand by Application in 2010

Cathay’s Industrial Bio Biz

So back to Cathay Industrial Bio, the company said its industrial biotech platform integrates strain development, fermentation scale-up and purification. In the biobutanol product, the company uses corn starch instead of dry milled whole corn, which acccording to them:

“..allows us to efficiently capture all co- and by-products produced during the bioprocess including co-products bioacetone and bioethanol, and corn and biogas by-products, thereby reducing production costs and capturing additional revenues.”

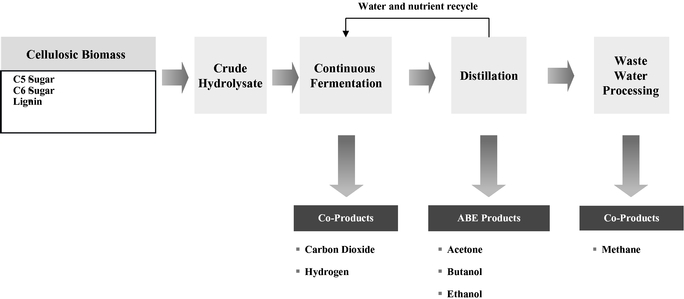

In cellulosic biomass feedstock, the company said it has developed a proprietary inhibitor tolerant strain that is able to use crude biomass hydrolysate as feedstock (no idea what this means, sorry…). Cathay Industrial Bio also did not mention when they will specifically start commercialization of cellulosic-based n-butanol, which the company said, will enable them to reduce production costs and therefore could lead them to enter the biofuels market as well.

However, the company said they historically been able to complete lab testing in 3-6 months, pilot plant testing in 3-4 months and commercial production engineering in 9-12 months.

Cathay’s Biorefinery Model (Cellulosic biomass as feedstock)

In terms of China’s cellulosic biomass industry, Jilin Province in northeast China reportedly produced around 18m tonnes of corn in 2010. Corncobs are collected in Jilin Province on a commercial scale for cellulosic biomass based production of xylose, an intermediate of xylitol, a sweetener, and furfural, a specialty chemical intermediate.

“As such, we have ready access to established infrastructure and logistics for the collection, storage and handling of corncobs near our biobutanol production facility in Jilin Province. Based on our technology parameters as of March 31, 2011, we expect to require less than 0.7 million metric tons of cellulosic biomass if we produced 100,000 metric tons of ABE from cellulosic biomass in our production facility in Jilin Province, which represents approximately 3.9% of the cellulosic biomass produced in Jilin Province in 2010, assuming one ton of cellulosic biomass is produced for every ton of corn.”

There are a lot more interesting information on both bio-butanol and renewable based LCDAs which you can read in the S-1 filing.

So in conclusion after all these wonderful information, the company plans to use the proceeds for the IPO to further develop, commercialize and expand its biobutanol; construct a facility for the commercialization of I+G (Disodium Inosine-5′-monophosphate and Disodium Guanosine-5′-monophosphate – a food flavor enhancer that complements monosodium glutamate); expand production capacity for LCDAs; and expand/strengthen other R&D infrastructure and activities.

Morgan Stanley, Deutsche Bank Securities, and Jefferies & Co. are the lead underwriters on the deal.

Source

ICIS Green Chemicals, 2011-07-26.

Supplier

Arkema

Cathay Industrial Biotech Ltd.

Cobalt Technologies, Inc.

DuPont

Evonik Industries AG

Novo Nordisk A/S

Tetravitae Bioscience

Share

Renewable Carbon News – Daily Newsletter

Subscribe to our daily email newsletter – the world's leading newsletter on renewable materials and chemicals