In the framework of the European project BIOFOREVER, nova-Institute has conducted a second survey round on GreenPremium prices for bio-based products and related questions.

Deutsche Fassung: https://renewable-carbon.eu/news/bioforever-detaillierte-bewertung-der-greenpremium-preise-fuer-biobasierte-produkte-entlang-der-wertschoepfungskette/

Results have been published in a paper which can be downloaded for free at https://bioforever.org/sites/default/files/publications/2018-03/Detailed-eval-GreenPremium-prices-for-bb-prod-along-value-chain.pdf and www.bio-based.eu/markets. The study will be presented by Michael Carus, Managing Director of nova-Institute, at the 11th International Conference on Bio-based Materials 15-16 May in Cologne, Germany (www.bio-based-conference.com).

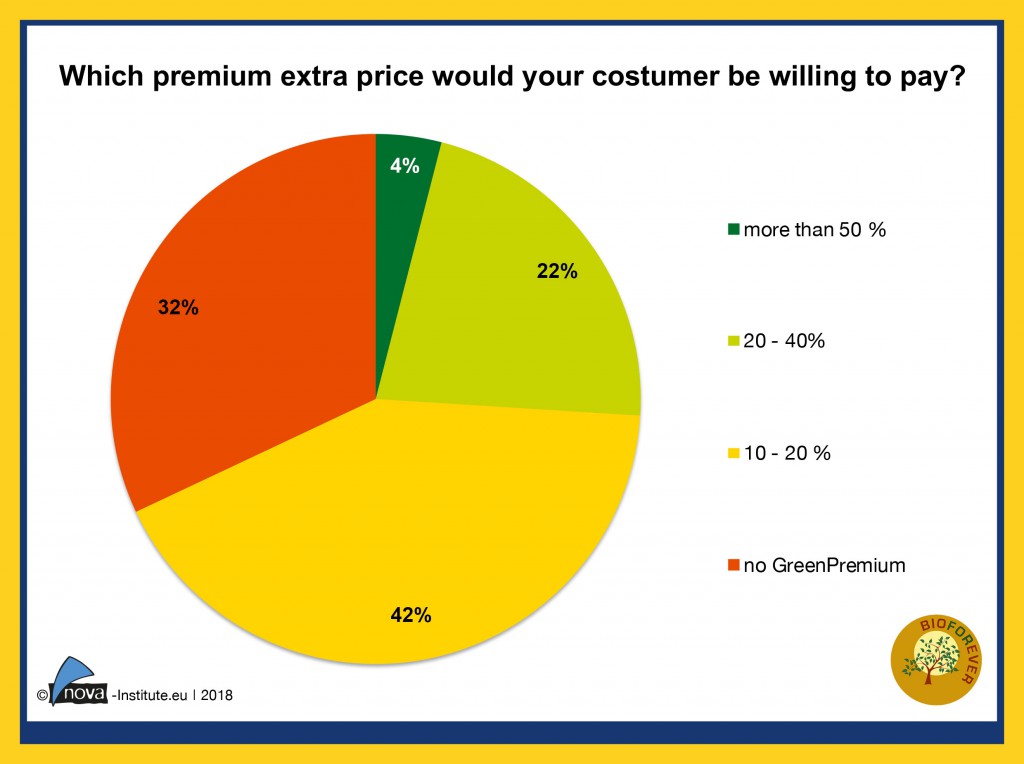

Almost 70% of industry experts report GreenPremium prices for bio-based products. Most of the participants (42%) considered the GreenPremium to range between 10-20%, 22% indicated a price premium of 20-40%. The GreenPremium is not limited to a certain period, almost 60% of the respondents expect no time limit for GreenPremium at all. A comparison of results of the different surveys from 2013, 2016 and 2017 shows that overall, the response patterns have changed only little.

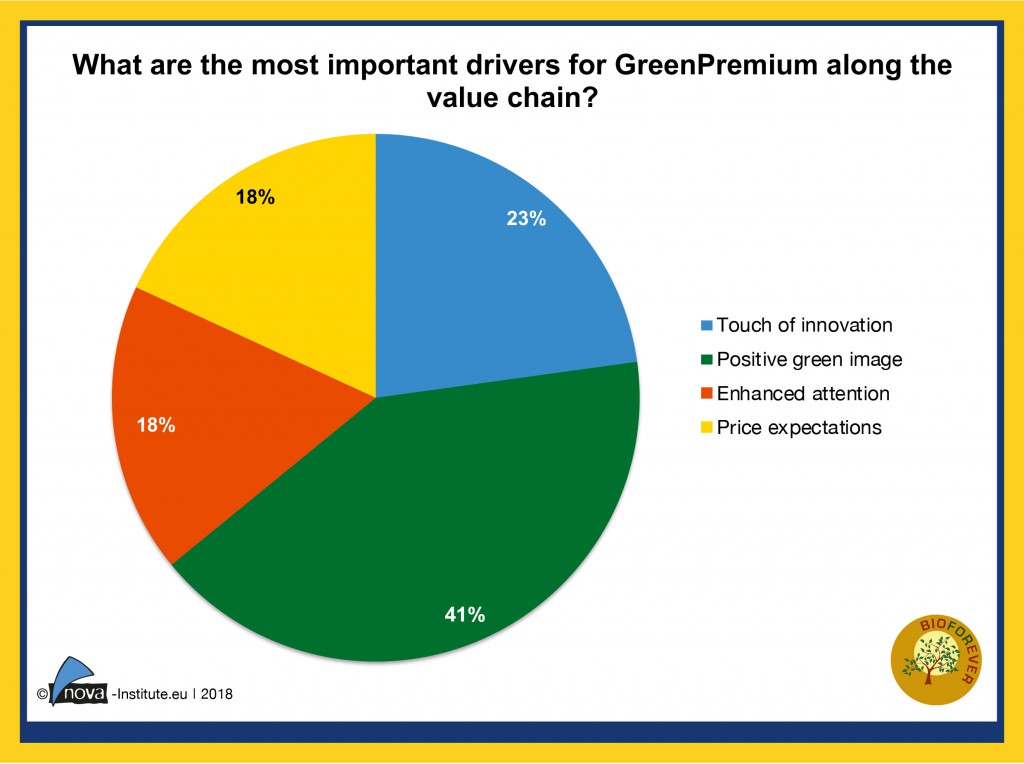

The most important driver for GreenPremium is not very surprising: a positive green image, but also other relevant drivers were found in the survey: Touch of innovation and enhanced attention at media. Additionally, single value-adding factors were named by the participants. The highest ranked factor determining the GreenPremium price is the “Higher bio-based share of the product“ (64%), followed by “Lower greenhouse gas emissions” (46%) and “Biodegradability” (46%).

Several years of market analysis and manifold contacts to bio-based producers have shown that bio-based products achieve GreenPremium prices in many applications. Also the vigorous activities by big players to establish the “biomass balance approach” on the market clearly show that there is a relevant number of customers who are willing to pay a GreenPremium price for a bio-based material and product.

This study in the framework of the European project BIOFOREVER explores the phenomenon of GreenPremium prices in further detail. Are there differences along the value chain? Differences between distinct applications and sectors? Does the feedstock question, first or second generation biomass, play a relevant role? What do market participants expect in terms of how long GreenPremium prices for their products are going to last?

The 50 participants of the survey can be identified as true insiders who either produce or trade bio-based products (or intermediates) themselves or consult related companies. These experts have in-depth market knowledge, granting the results a high credibility. Almost 70% of these experts report GreenPremium prices for bio-based products. Most of the participants (42%) considered the GreenPremium to range between 10-20%, 22% indicated a price premium of 20-40%. About 4% of the respondents see a willingness to pay even more than 50%. 32% of the participants report no GreenPremium prices.

A comparison of results of the different surveys from 2013, 2016 and 2017 shows that overall, the response patterns have changed only little. In all surveys, the range of “10-20%” GreenPremium is the most frequent answer and “more than 50%” is the least reported response. The most visible trend is an increase in the frequency of the “20-40%” range, while the “10-20%” and “more than 50%” are mentioned slightly less often over the years. At the same time the naming of “no GreenPremium” has increased (from 16% in 2016 to 32% in 2017).

It is important to know to what extent new technologies – that may require large investments – can rely on GreenPremium prices for their products on a long-term basis. The results of the survey show that almost 60% the respondents expect no time limit for GreenPremium at all. 30% see a limitation to the next five years, 8% to the next ten years.

The result for the most important driver for GreenPremium is not very surprising: a positive green image has been identified as the most important reason for GreenPremium prices being paid (41%). But there were also other relevant drivers found in the survey: Touch of innovation (23%), enhanced attention at media can be achieved using bio-based materials instead of standard materials (18%) and expectations for higher prices (18%).

Additionally, single value-adding factors were named by the participants. The highest ranked factor determining the GreenPremium price is the “Higher bio-based share of the product” (64%) and is especially dominant in construction (71%). “Lower greenhouse gas emissions” (46%) and “Biodegradability” (46%) are the next important single value-adding factors for GreenPremium prices. “Biodegradability” is less important (22%) in consumer goods, but important for packaging (45%).

The importance of “Sustainability certification of the biomass feedstock” (24%) is ranked differently throughout the application groups, for packaging the importance (36%) is higher than for consumer goods (11%). “2nd generation biomass” and “GMO-free biomass” are the lowest ranked factors. GMO-free biomass is named only by 20% of the participants as important value-adding factor. An exception seems to be packaging, where GMO-free biomass (41%) reaches the same level of importance as “Biodegradability” and “Lower greenhouse gas emissions”.

“2nd generation biomass” as a motivating factor displays less variation between the application groups and has only low relevance (20%) as a single driver of GreenPremium prices. In further research within the framework of the project BIOFOREVER, a detailed evaluation is planned in order to understand why a feedstock base of “2nd generation biomass” does not seem to play a large role in triggering GreenPremium. For example, a possible reason could be that the discussion about 1st and 2nd generation biomass feedstock was rather a discussion in the political arena than in the market or at the end customer level. Another explanation could be lack of awareness and understanding among end consumers.

About the project

The main objective of BIOFOREVER (BIO-based products from FORestry via Economically Viable European Routes) is the technical and economical demonstration of five different value chains from feedstock to final product. Within this framework, several conversion technologies will be demonstrated up to pre-industrial scale for several types of feedstock while commercialization routes for the most promising value chains will be delivered. The BIOFOREVER project has received funding from the Bio-Based Industries Joint Undertaking (BBI-JU) under the European Union’s Horizon 2020 research and innovation programme under grant agreement No. 720710.

www.bioforever.org

Source

nova-Institut GmbH, press release, 2018-03-28.

Supplier

Share

Renewable Carbon News – Daily Newsletter

Subscribe to our daily email newsletter – the world's leading newsletter on renewable materials and chemicals