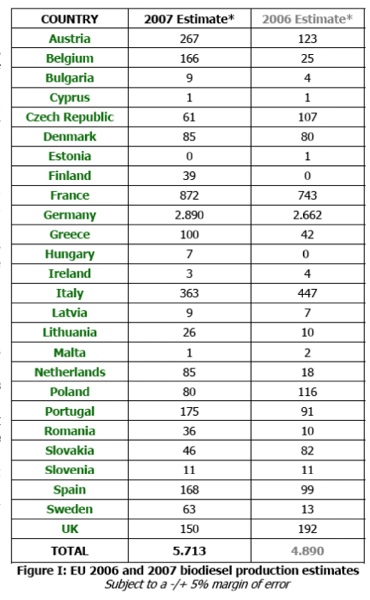

The European Biodiesel Board’s (EBB) official statistics show a much lower rate of growth in the year 2007 compared to previous years. Production increased from 4.9 million tonnes in 2006 to 5.7 million in 2007. This represents a yearly growth of only 16.8% compared to 54% last year and 65% in 2005.

Biodiesel production has decreased in 6 of 26 Member States since 2006, and has stagnated in many other countries, completely in contradiction with EU objectives. This highlights the negative change in market conditions in 2007, showing the difficulty for EU producers to compete with unfair B99 imports from the US. Against this background, EBB welcomes the Commission’s decision of last June 13th to initiate antidumping and antisubsidy investigations and hopes that this will lead to fair competition for biodiesel in the very near future.

Biodiesel production has decreased in 6 of 26 Member States since 2006, and has stagnated in many other countries, completely in contradiction with EU objectives. This highlights the negative change in market conditions in 2007, showing the difficulty for EU producers to compete with unfair B99 imports from the US. Against this background, EBB welcomes the Commission’s decision of last June 13th to initiate antidumping and antisubsidy investigations and hopes that this will lead to fair competition for biodiesel in the very near future.

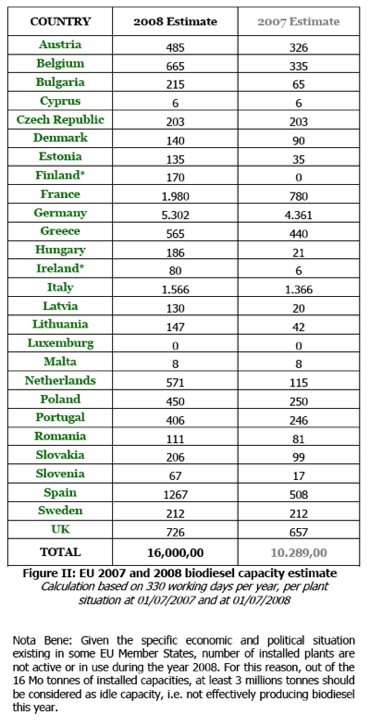

Biodiesel producers have long since committed substantial capital investment to reaching the objectives of the EU biofuels Directive. Installed plant capacity (potential per plant production capacity calculated considering that the plant was able to run at full production rate for a whole year) increased by 55% in 2007, to 16 million tonnes capacity in 2008. The number of plants as of July 2008 is 214. EBB statistics for 2008 however show that 3 million tonnes of installed capacity remains idle due to the lack of a viable market for biodiesel in Member States. This means that the important investment from the industry has not been matched by the creation of an effective legislative and regulatory environment for biofuels at EU level.

In terms of production capability the EU biodiesel industry stands ready to reach the 10% biofuels binding target for 2020 agreed at the March 2007 European Council but it can only do so in a fair market environment with adequate demand for the renewable transport fuel. In the view of EBB a number of urgent legislative and standardisation measures need to be taken in order to create a genuine market for biodiesel at EU and Member States level:

- The 10% binding target for biofuels to be reached by 2020 should be secured in the framework of the future Renewable Energy Directive. Most importantly, the new Directive should ensure that Member States implement effective policies to achieve the 10% binding target for biofuels by creating binding interim targets of 7% in 2012 and 8,5% in 2015 (expressed in energy content).

- There needs to be a fair and balanced assessment of the greenhouse gas saving potential of different biofuels pathways. In this framework, the cut-off value contained in the RE-D Directive as well as the underlining methodology and default data should be based on objective, transparent

figures. In this sense EBB has requested the Commission realise a study comparing GHG emissions from biofuels with the marginal fuels available in the markets i.e. fuels from unconventional oil extraction such as Tar Sands from Canada. - The restrictive ceiling of 5% FAME content in fossil diesel specification EN590 has to be amended quickly to permit 10% and 15% content without labeling to ensure EU targets are capable of being reached. Although mandated by the European Commission to work in that direction, the CEN has shown little progress towards the adoption of amended diesel specifications.

In 2007, biodiesel accounted for 76% of the biofuels consumed in the EU (EU bioethanol production for 2007 was 1,4 million tonnes) and is likely to remain the leading biofuel in meeting the target of 10% transport fuels by 2010. The continuing trend of increasing diesel car ownership and increasing need for imported diesel while gasoline demand is decreasing will ensure biodiesel is an important contributor toward Europe’s energy security strategy.

In 2007, biodiesel accounted for 76% of the biofuels consumed in the EU (EU bioethanol production for 2007 was 1,4 million tonnes) and is likely to remain the leading biofuel in meeting the target of 10% transport fuels by 2010. The continuing trend of increasing diesel car ownership and increasing need for imported diesel while gasoline demand is decreasing will ensure biodiesel is an important contributor toward Europe’s energy security strategy.

At the international level Europe remains the world’s largest producer and consumer of biodiesel although other market players are emerging. In 2007, the EU produced 68% of biodiesel manufactured world-wide. The US industry in particular has grown exponentially in the last four years. American production tripled in 2005, tripled again in 2006 and doubled in 2007 to reach 450 million gallons (approximately 1,5 Million tonnes), a growth that is mainly driven by the “B99” subsidisation scheme. At the same time in 2007, the US exported some 1 million tonnes of biodiesel towards the EU, given the unfair advantage it is awarded by the US B99 subsidy which gives American biodiesel exporters a €150 to €200/m3 cost advantage over European biodiesel.

In light of much emotional debate about sustainability, it is worth reminding that EU biodiesel production draws the vast majority of its feedstock from some of the most environmentally regulated sectors in the world i.e. from European farmers and agriculture. Further strengthening of these criteria in the RE-D is welcomed and European producers are ready to set the international standard for sustainability.

In summary, Europe has the potential to achieve climate change, rural development and security of energy supply objectives based on the development of the European biodiesel industry to date. The existing EU biodiesel industrial capacity clearly represents an asset in this sense, provided that this capacity will not remain largely unexploited as is unfortunately the case today. 2007 statistics show that the viability of European markets is being eroded by unfair competition from US B99 and inappropriate implementation of Member States policies. EU biodiesel producers are confident that a fair international trade environment will soon be reestablished and that more appropriate legislative and market conditions will be created to fully exploit the opportunities linked to the development of biodiesel markets, notably with the definitive adoption of a 10% binding target for biofuels.

EBB Press release of 2008-06-25: 2007 – 2008 Production statistics show restrained growth in the EU due to market conditions and competition from US B99 imports. (PDF-Document)

Contact

European Biodiesel Board

Mr. Raffaello Garofalo, Secretary General

Tel.: 0032-27 63 24 77

E-Mail: secretariat@ebb-eu.org

Source

European Biodiesel Board (EBB), press release, 2007-06-28

Supplier

European Biodiesel Board (EBB)

European Commission

European Council

Share

Renewable Carbon News – Daily Newsletter

Subscribe to our daily email newsletter – the world's leading newsletter on renewable materials and chemicals