Last year, industrial hemp showed record cultivation figures in Europe, Canada and China. In addition, cultivation has begun in the USA. The highest growth in demand comes from the food sector, food additives and pharmaceuticals. But hemp fibres are also increasingly being sold to the automotive and construction industries. The turnover in the industrial hemp sector has meanwhile reached new dimensions, with numerous new companies getting listed on the stock exchange. The conference is expected to attract 400 participants from 50 countries.

German version: https://renewable-carbon.eu/news/hanf-wird-zum-milliardengeschaeft-weltweit-groesste-konferenz-zu-industriehanf-im-juni-2019-in-koeln/

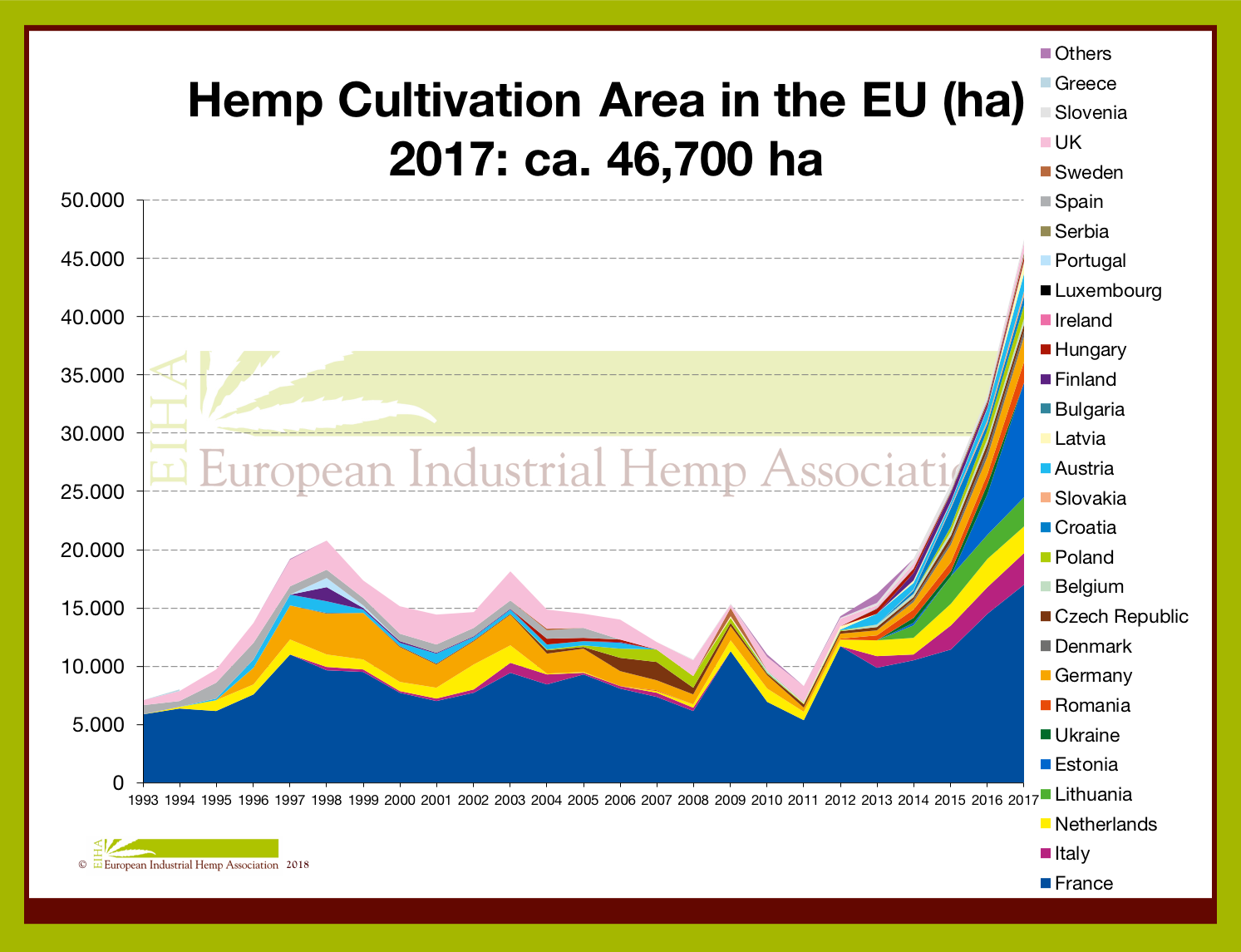

Industrial hemp in Europe

For a long time, the hemp cultivation in Europe was on decline, and only in France it was continuously practiced. The reintroduction of industrial hemp started in Great Britain in 1990, a few years later it also took place in The Netherlands and Germany and finally all throughout Europe. During the brief hype in the 1990s, the area under cultivation rose to 20,000 ha and then fell back to around 8,000 ha in 2011. Only afterwards, the industrial hemp industry really started. After 26,000 ha in 2015 and 33,000 ha in 2016, the area under cultivation rose to around 47,000 ha in the year 2017.

Hemp food

The growing areas are mainly driven by demand in the food sector. The healthy cannabis seeds have arrived in the mainstream and can be found today in almost all European supermarkets, either pure, in muesli, in chocolate or many other products. Like soya, hemp seeds can be processed into drinks and yoghurts. Oil pressing leaves a protein-containing press cake from which proteins for athletes are extracted. Currently, there is no end in sight to the rising demand.

Cannabidiol (CBD)

A further upswing came with the market launch of the non-psychotropic cannabidiol (CBD), which has mildly calming and focussing effects in low doses, and also medical effects in higher doses. It is extracted from the leaves and flowers of hemp and is used, for example, as a food supplement and in e-cigarettes. Here, too, the demand is high, but cannot be sufficiently met due to a patchwork of national regulations. While discounters successfully sell CBD cigarettes in Switzerland, concentrated CBD is a prescription drug in other EU countries. So far, there are no uniform legal regulations in Europe. As a food supplement, concentrated CBD was classified as a novel food in January 2019 and must therefore first undergo the approval process.

Pharmaceuticals

Tetrahydrocannabinol (THC) is approved as a drug in virtually all European countries and is commercially produced by the pharmaceutical industry in greenhouses. Strong growth has also been recorded here. As of November 2018, an estimated 40,000 patients had been prescribed Cannabis in Germany. The industry estimates that number could eventually climb to 1 million, and to 5 million total across the European Union. With the annual cost of therapy between €4,500 and €30,000, it’s potentially a multibillion-euro market. Experts predict the German market will reach as much as €6 billion/year in sales over the next 10 years1.

Greece legalised cannabis for medical use in 2017 and lifted a ban on growing and producing it in March 2018. The first licenses are expected to produce $211 million in initial investments and soar to as much as $1.15 billion in three years. The first licensed products expected to hit the market at the end of 20192.

Fibres and shives

Finally, hemp fibres are used in large quantities for lightweight construction in the automotive industry (e.g. door linings), in biocomposites of all kinds, in insulating materials and for thin, tear-resistant papers (e.g. cigarette and bible papers). The shives, the inner part of the hemp stem, are used as building material and animal bedding. These are established markets with largely constant volumes and only moderate growth. Only political support for bio-based or climate-friendly materials could generate higher growth rates here.

Developments of cultivation areas outside Europe

But not only in Europe industrial hemp enjoys considerable demand again. In Canada, a dynamic hemp food industry with steady growth emerged even ahead of Europe. In 2016, 34,000 ha of hemp were cultivated in Canada and in 2017 a new record was achieved with 56,000 ha. In 2018, the cultivation of industrial hemp also began in the USA, where an additional 50,000 ha of industrial hemp cultivation are expected in the next ten years.

Furthermore, in China, the mother country of hemp, the plant is reintroduced mainly for the textile industry in order to relieve cotton production and potentially even replace it later. In the northeast of China there are large programs to introduce enzymatically opened hemp fibres into the textile industry. The Chinese automotive industry also uses hemp fibres in lightweight construction. The total area under cultivation in China has risen from 40,000 ha (2016) to 47,000 ha (2017).

Worldwide market value

Industrial hemp had almost completely disappeared after the Second World War, and despite the worldwide prohibition of cannabis as a crop by the United Nations, Canada, China and the European Union are again legally cultivating a total of 150,000 ha in 2018 – in just a few decades hemp cultivation could exceed the millions of hectares and hemp could once again become an important crop.

According to the European Industrial Hemp Association (EIHA), the hemp sector, especially the business with hemp extracts, has grown rapidly in recent years. For example, hemp products in the USA reached a market value of 688 million dollars in 2016 and exceeded an estimated global volume of 1 billion euros in 2017. According to EIHA estimates, the European market value is around 120 million euros. Together with the hemp industry in China (textiles, food, cosmetics, CBD) and other countries, the nova-institute estimates the total market value of hemp products in the world in 2018 at around €1.5 billion (without pharmaceuticals).

Meeting point of the worldwide hemp industry

The worldwide growing hemp industry meets every year in Cologne for the “EIHA Hemp Conference”, which is organized by the nova-institute in cooperation with the European Industrial Hemp Association (www.eiha.org), with about 150 members from all areas of industrial hemp use. On 5 and 6 June 2019, 400 participants from 50 countries are expected to attend the “16th EIHA Hemp Conference” in Cologne. The day before the conference, EIHA will host expert workshops for members, meet representatives from Canada, the USA and China, and hold its General Assembly in the evening. Anyone who works on the topic of industrial hemp worldwide or is interested in it should not miss this conference. Numerous rooms and professional tools guarantee small, confidential meetings for efficient business contacts. Be part of it!

Now is the right time to submit presentations, to apply for the “Hemp Product of the Year 2019” Innovation Award and above all to book exhibition stands. Based on experience from previous years, these quickly become scarce. If you are interested, you will also find attractive sponsoring opportunities. All information under: www.eiha-conference.org

Author: Michael Carus, Managing Director of the nova-institute (www.nova-institute.eu) in Hürth near Cologne. Carus was Managing Director of the European Industrial Hemp Association (EIHA) for thirteen years (until the end of 2018) and is currently a member of EIHA’s Scientific Advisory Board. He was significantly involved in the reintroduction of industrial hemp in Germany and Europe and has prepared numerous studies on different aspects of hemp use at the nova-institute.

1 www.handelsblatt.com/today/companies/cannabis-why-cant-germany-get-its-medical-marijuana-industry-going/23811676.html; letzter Zugriff 2019-01.

2 www.greenmarketreport.com/greece-gears-to-issue-multiple-cannabis-licenses-as-govt-opens-doors-to-growers/; letzter Zugriff 2019-01.

Download press release as PDF file: 19-01-30 PR EIHA Hemp Conference

Source

nova-Institut GmbH, press release, 2019-01-30.

Supplier

European Industrial Hemp Association (EIHA)

nova-Institut GmbH

Share

Renewable Carbon News – Daily Newsletter

Subscribe to our daily email newsletter – the world's leading newsletter on renewable materials and chemicals