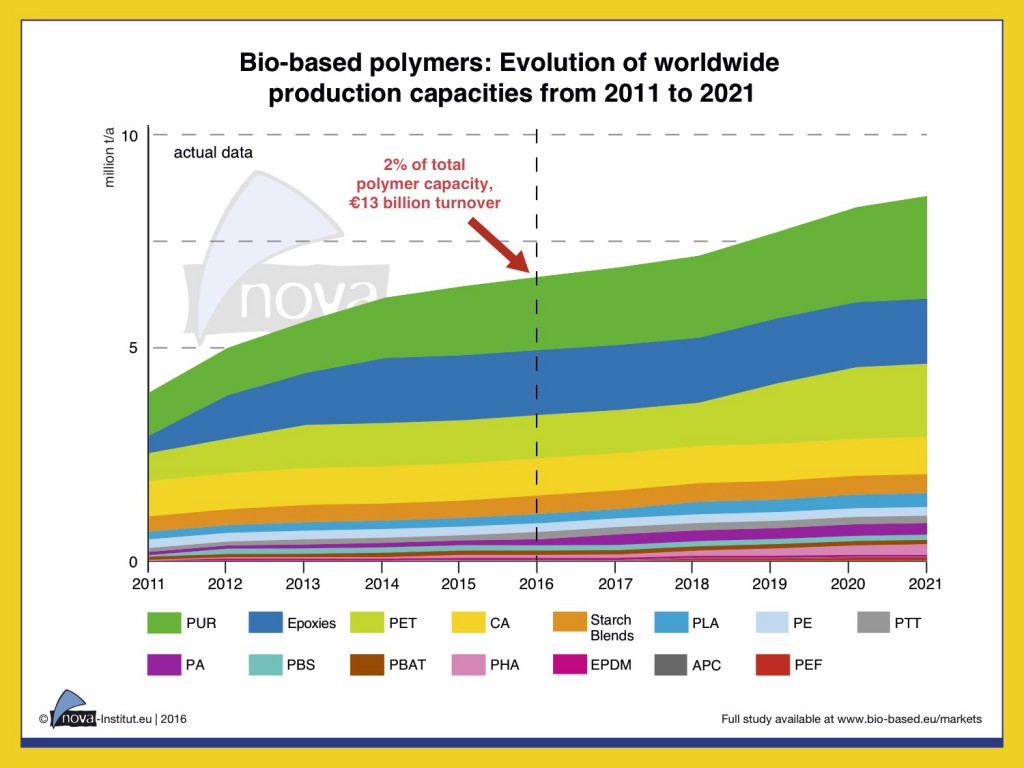

The worldwide production capacity for bio-based polymers grew by 4% to 6.6 Million tonnes from 2015 to 2016. This represents a share of 2% of the global polymer market. The bio-based polymer turnover was about €13 billion worldwide in 2016 compared to €11 billion in 2014. Production capacity of bio-based polymers is forecasted to increase from 6.6 million tonnes in 2016 to 8.5 million tonnes by 2021.

Deutsche Version: https://renewable-carbon.eu/news/bio-basierte-polymere-weltweit-wachstum-trotz-schwierigem-marktumfeld

The development of the bio-based polymer market aligns to the overall growth rate of the polymer market as a whole. In contrast to a 10% annual growth between 2012 and 2014, the capacity growth data now show a 4% annual growth rate from 2015 to 2021. This is almost the same as for the overall global polymer capacity. The main reasons for this slower increase in capacity are low oil prices, poor political support and a slower than expected growth of the capacity utilization rate.

Not all bio-based polymers are biodegradable, but some important ones are, e.g. polyhydroxyalkanoates (PHA), polylactic acid (PLA) and starch blends. Strong political support can only be found in Italy and France for biodegradable solutions in the packaging sector. In this sector, the global demand for biodegradable packaging still shows a double digit growth. Additional demand could come from the increasing microplastic problem (marine littering), but so far biodegradable plastics have not benefitted from this debate.

The most dynamic development is foreseen for the new bio-based polymers polyhydroxyalkanoates (PHA), which belong to the big family of different polymers. PHA production capacity was still small in 2016 and is projected to almost triple by 2021.

The second most dynamic development is foreseen for polyamides (PA), whose production capacity is expected to almost double by 2021. Bio-based drop-in PET and new bio-based polymer PLA are showing approximately 10% annual growth rates.

Bio-based building blocks show vivid market development

In addition to bio-based polymers, the nova market report studies seventeen bio-based building blocks as precursor of bio-based polymers. The total production capacity of the bio-based building blocks reviewed in the report was 2.4 million tonnes in 2016 and is expected to reach 3.5 million tonnes in 2021, which means an annual growth of 8%.

The building block market shows a more vivid development than the bio-based polymer market. The bio-based building block annual capacity growth rate is twice as high. The most dynamic developments are spearheaded by succinic acid and 1,4-BDO, with monoethylene glycol (MEG) as a distant runner-up. Bio-based MEG, L-lactic acid (L-LA), ethylene and epichlorohydrin are relatively well established on the market.

Market outlook on bio-based polymers in several market fields

Most investment in new bio-based polymer capacities will take place in Asia because of better access to feedstock and a promotive political framework. Europe’s share and North America’s share are projected to decrease slightly.

Most bio-based polymers are consumed by the packaging industry. The major part of this is rigid packaging (bottles and others) and the rest as flexible packaging (films and others). This is not surprising since bio-based PET (mostly used to produce bottles) is one of the biggest bio-based polymers in terms of capacity.

The packaging industry has a considerable interest in biodegradability since packaging is only needed for short time use but in big quantities. This contributes to the accumulation of waste. Biodegradable polymers can be one possible solution to solve this problem.

The biodegradation of different polymers takes place in different environments; some polymers need industrial composting, others work also in home composting and a limited number also in soil, fresh water or even in the ocean. Therefore, biodegradation of polymers is also interesting for agriculture and horticulture applications (e. g. mulch films).

However, besides the packaging sector, bio-based polymers are also used in many different other market segments, mainly in durable applications such as construction or high-performance automotive applications.

The nova market report is unique and shows the most comprehensive data ever published

nova-Institute’s market study “Bio-based Building Blocks and Polymers – Global Capacities and Trends 2016 – 2021” is unique and gives the most comprehensive insight into the bio-based world market with latest data on capacities and applications for all relevant bio-based building blocks and polymers. The report shows real data for the year 2016 and a forecast for 2021. The data are collected by a high-level biopolymer expert group from Asia, Europe and the US with direct contact to the leading bio-based building block and polymer producers in the world. The data of the annual nova market report is regularly used by leading brands of the industry and constitutes the basis of European Bioplastics’ annual market update, relying on the proven high and outstanding quality of nova-Institute’s research.

Hasso von Pogrell, Managing Director of European Bioplastics: „…including an annual global market data update, for which we rely on the longstanding market research expertise of nova-Institute. Our market data update 2016 has been conducted together with nova-Institute and is based on the study ‘Bio-based Building Blocks and Polymers’, from which we extract the data for our defined scope of new economy bioplastics.”

The nova report provides insight into the future developments of the bio-based building block and polymer markets worldwide. Companies benefit from solid data and market analyses of renowned experts with specialist knowledge and long years of expertise.

The report contains more than 50 figures and 140 tables, production capacities in North and South America, Asia and Europe from 2011 to 2021 for seventeen bio-based building-blocks and thirteen polymers, and the different application sectors per polymer. In addition, the report shows detailed company profiles of 104 companies, which produce 70 different bio-based building-blocks and polymers.

In total, the report has 249 pages and is available for 2,000 € at www.bio-based.eu/reports

Press release as PDF file: 17-02-20 PR Bio-based polymers data

Source

nova-Institut GmbH, press release, 2017-02-20.

Share

Renewable Carbon News – Daily Newsletter

Subscribe to our daily email newsletter – the world's leading newsletter on renewable materials and chemicals